Understanding Refunds with the Internal Revenue Service: A Comprehensive Guide

BlogTable of Contents

- What Is The IRS And How Does It Work? (Updated 2024)

- Irs Photos, Download The BEST Free Irs Stock Photos & HD Images

- Homepage of Internal Revenue Service Website on the Display of PC, Url ...

- IRS Directions for Using New Tax Withholding Calculator – NBC4 Washington

- IRS Gives Tax-Return Update - Newsweek

- The IRS - YouTube

- IRS requires more info for digital asset transactions

- A new IRS program is helping its first users file their income taxes ...

- IRS Announces 1st Relief Payments, Says More to Come

- The IRS launched its free Direct File tax filing program. Here's what ...

What is a Refund?

How Do Refunds Work?

Types of Refunds

There are several types of refunds, including: Tax Refund: The most common type of refund, which is the amount of money the IRS owes you after processing your tax return. Amended Return Refund: If you file an amended return (Form 1040X) and are due a refund, the IRS will process it separately from your original return. Interest on Refund: In some cases, the IRS may owe you interest on your refund, which is calculated from the original due date of your return.

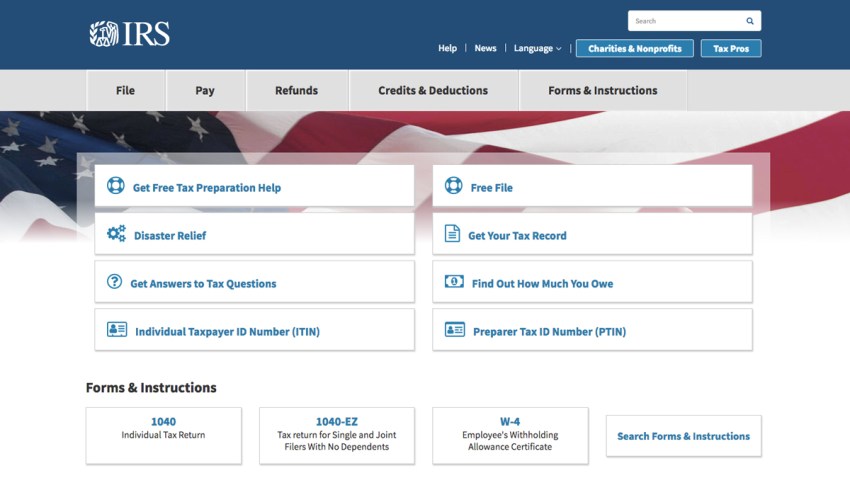

How to Check Your Refund Status

Wondering where your refund is? You can check the status of your refund using the IRS's "Where's My Refund?" tool. This online tool allows you to track your refund and receive updates on its status. You can also call the IRS refund hotline at 1-800-829-1040 to speak with a representative.

Tips for Getting Your Refund Quickly and Securely

To ensure you receive your refund promptly and securely, follow these tips: E-file your tax return: Electronic filing is faster and more accurate than paper filing. Choose direct deposit: Direct deposit is the fastest way to receive your refund, and it's also more secure than paper checks. Keep your personal and financial information up to date: Make sure the IRS has your current address, bank account information, and other relevant details to avoid delays. In conclusion, understanding refunds with the Internal Revenue Service is crucial to ensuring you receive your money promptly and securely. By knowing how refunds work, checking your refund status, and following tips for quick and secure refunds, you can make the most of your tax refund. Remember to always stay informed and up to date with the latest IRS guidelines and regulations to avoid any potential issues with your refund.For more information on refunds and other tax-related topics, visit the IRS website or consult with a tax professional.